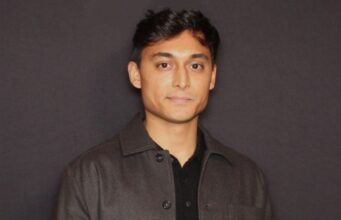

Associate Professor of Finance Jim Rosenfeld has been in the news recently talking about reverse stock splits and the future of Citigroup. At Goizueta since 1983, Rosenfeld has long looked at issues of corporate restructuring and trends in the market.

Associate Professor of Finance Jim Rosenfeld has been in the news recently talking about reverse stock splits and the future of Citigroup. At Goizueta since 1983, Rosenfeld has long looked at issues of corporate restructuring and trends in the market.

G-NEWS: Can you talk about Citigroup and your research with April Klein (NYU) on reverse splits?

JR: “Our research focused on every reverse split that took place (1,600 firms) from 1961 to 2001. I actually got the idea around ten years ago from a USA Today article talking about reverse splits. I did a little research and it seemed that very little had been done on this topic. I decided to look at it myself and the first thing that came to my mind was to see how the stock price of these companies performed over the long run. Our results showed they were very poor performers over a three-year period following the date of the reverse split relative to comparable firms. That was the first part of our study, but we decided to go a little bit beyond that.”

“We found that when firms announce the reverse split, the market reacts negatively. Then we looked at what happens on the day of the reverse split and found that the value of the stock actually falls by an average 5 or 6 percent on a risk-adjusted basis. This was unusual because everybody knows when a reverse split is going to take place. What’s the big surprise? We explored that and found out it was a function of transactions costs. You know that the value of your stock is going to go down on the date of the reverse split, so any sane person would say ‘dump the stock the day before.’ But most of these companies are trading under a dollar a share so their bid-ask spreads are very wide. This means that you could lose 10 to 20 percent of the stock’s value by selling just before the split. On the day of the reverse split the stock price may go down 5 percent, but the bid-ask spread also becomes very small and so do the transaction costs. You’re actually better off waiting for the reverse split and having it go down before you sell it.

“Furthermore, if you knew that a stock was going to have a reverse split and, anecdotally, you can see what happens to these things over time, why not sell them short? We found that most of these stocks were unshortable because a large percentage were trading under a dollar a share… Efficient market theory says this underperformance shouldn’t happen. However, if you can’t take advantage of this information, that’s still consistent with efficient market theory. It may underperform, but you still can’t profit from it because you couldn’t sell the stock short. We were the first study to show that this underperformance phenomenon was within the context of efficient market theory.”

G-NEWS: Because of the Financial Crisis, how is the Citigroup example different?

JR: “Citigroup is not your typical reverse split company and neither is AIG. It was created by the Financial Crisis. Look at Citigroup – it’s one of the most actively traded companies on the exchange right now. This is because the stock is so cheap – it trades less than $5 a share – so that anybody with money in their pocket can afford to own a share of Citigroup. In the case of Citigroup it wasn’t a question of being de-listed, it was a question of having a penny-stock image [and] trading at less than $5 a share. Most institutions, especially those with fiduciary responsibilities, can’t buy a stock that trades under $5. So Citigroup decided to reverse split their way out of this.

“When they made the announcement the market reacted negatively — not incredibly negative, but it was consistent with what we’ve seen before. The value of the stock dropped 2 or 3 percent on the day of the announcement just like most of the other reverse splits in our sample. You might think ‘wait a minute, look at all the positives Citigroup is going to reap out of this: get rid of the penny-stock image and all this other stuff…’ In most cases, as a firm’s earning/share goes up, the value of its stock also goes up. But the fact that Citigroup chose to have to have a one for 10 reverse split to get out of this $5 range [shows] they’re not very confident that in the near future they’re going to be able to earn their way out of this mess. They’re doing it artificially so this gives out the wrong signal, I think, to the market. Citigroup with all its power and gusto can’t grow their way out of that sub-$5 range.

“So far the market’s reaction, in every way, has been the same as its reaction to our sample of 1,600 companies. This doesn’t bode well for Citigroup’s stock price performance over the next three years. We’ll have to wait and see.”

G-NEWS: What are some other research interests for you?

JR: “Most of my work is involved in corporate restructuring. When I started out around 30 years ago, we did research on spinoffs and selloffs and basically had the first papers published by a major journal in these topics. Spin-offs and sell-offs are a form of corporate restructuring. It’s a way of divesting yourselves of a subsidiary or division that you don’t want. I did most of that work in the 80s but, from time to time, something will come up that interests me in that area and I’ll work on it.

“Lately, we’ve been looking at split-ups, which is an exaggerated spinoff. In a spinoff you have a parent company that divests itself of a division by giving 100 percent of its stock to the shareholders. Now the shareholders own stock in both the parent company and the spinoff. In a split-up, every division in the company is spun off. This is something that, frankly, nobody has looked at very closely.

G-NEWS: What are some examples of split-ups?

JR: “In the modern era, AT&T was the first major split-up as well as the largest split-up ever. It occurred in 1984. The Justice Department said ‘AT&T, you have a monopoly; you have to divest yourself of all your subsidiaries.’ In one fell swoop you had the creation of AT&T, which handled the long-distance operations, and the seven “Baby Bells” that handled the local operations in the states in which they operated. There have been others since then, but there hasn’t been a lot. That’s one reason why our research has been delayed, because we want a larger sample in order to look at these things.”

G-NEWS: Do you see split-ups becoming more common during this economic recovery?

JR: “I think so. We’re trying to create a sample right now, and lately it seems that every few months something is popping up in the press about a company breaking up all of its operations, like Tyco.

G-NEWS: Given the turbulent nature of financial markets, what do you want your students to know when they enter the workforce?

JR: “What I try to do in my class is bring the topics to life. I emphasize what’s happened in the news recently… I’ll start off with newspaper clippings and go through the whole sequence. I’ll spend maybe 10 to 15 minutes every class going through newspaper articles and then back up and [put in a lesson]. The main thing I try to do in the classroom is to show my students that these topics are relevant.

G-NEWS: How do you like to spend your free time?

JR: “I try to play tennis as much as I can and go to the gym three or four times a week. I also do a little traveling from time to time. I like driving down to Florida and visiting some of the spots there.”